How to Prepare for a Mortgage Loan Application

December 16, 2021Most people who are looking to buy a home will need to secure a mortgage.

A mortgage isn’t merely just a loan; a mortgage allows you to build equity in your home and increase your net worth.

There are many factors to consider when applying for a mortgage. For example, the total loan amount, your amortization period, your payment frequency and amount, your interest rate and renewal terms.

Don’t let that overwhelm you! Knowledge is power. Learn as much as you can about how mortgages work before applying for one and see what best suits your specific situation.

Here are some important things to consider before applying for a mortgage.

Credit Cards and Loans

Banks and other lenders will look at your current debts and loans. If you are carrying a large amount of credit card debt, now is the time to either pay them off in full or be sure the balance on your credit cards does not exceed 50% of your available credit. No debt or a lower ratio is best, but that is a good starting point. Your credit score will give your potential lender an overall view of your credit history. Be sure that your payments are up to date and don’t incur any more debt.

Don’t Fall into the Approval Trap

Banks and lenders have a formula and a very in-depth decision-making process when approving the amount of a mortgage for you.

You need to take a good honest look at your financial and life goals. Be sure the loan amount you accept is easily affordable each month.

Don’t opt-in for a higher amortization period to make your payments affordable. Think long-term and be realistic.

Don’t forget if you enjoy travelling and other life experiences, calculate monthly savings for those activities.

Your Employment History

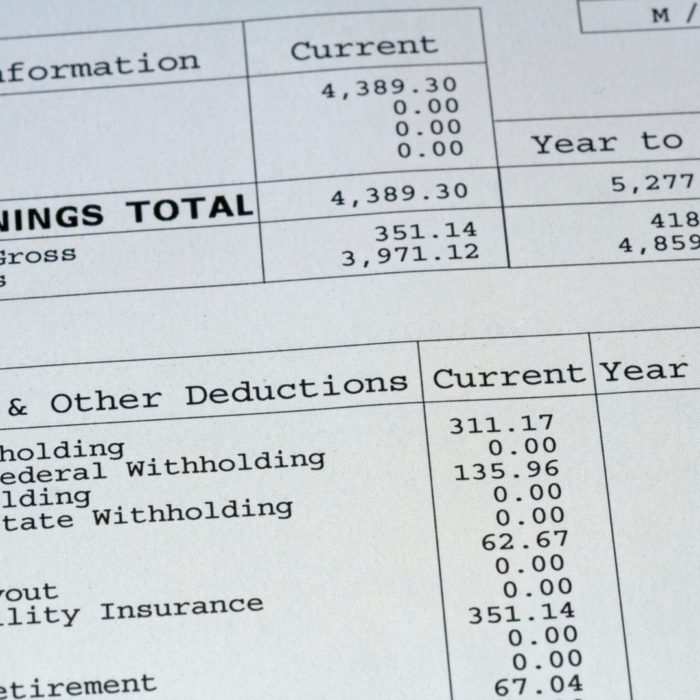

You will need to verify your current employer, salary and how long you’ve been working there. You will be asked to provide at least one month of pay stubs.

If you’ve recently started a new job, you will need to confirm your previous employment as well as explain any gaps in the employment, such as maternity leave or contract work.

If you are self-employed, you will need to show proof of income and will need to show your Notice of Assessments and at least a couple of years of tax returns.

Again, knowledge is power. Buying a home is not only a fantastic investment but a place where you will live, learn and grow with family and friends.

Learn as much as you can before you apply for a mortgage and carefully consider the best options for you which make “cents”!